Credit scores are extremely important whenever you apply for loans, mortgages, or a credit card. Having a good credit score could save you thousands of dollars and make it easier to qualify for the best loans and mortgages. This article overviews the types of credit scores, what makes them “good,” and ways to improve your credit score.

What Is A Credit Score?

Your credit score is a number that lenders use to gauge your credit risk, or how likely you are to repay your loans. A high credit score shows lenders that you will probably pay back your debt, whereas a low credit score suggests the opposite.

A low score also indicates that you have a high risk of default, which is when you decide that you can’t pay back the loan you took out. Defaults are bad for both you and the bank. They will ruin your credit score, and the lender loses a lot of money—a lose-lose situation.

Defaults and missed payments can cost lenders a lot. Thus, they are willing to give extra benefits to those with high credit scores because of the low default risk.

Your credit score plays a significant role in your life, especially when you’re about to apply for student loans, mortgages, auto loans, or credit cards.

What Credit Scores Exist?

Unfortunately, there’s not just one magical credit score out there. That would make life too easy.

Lenders tend to focus on three:

- FICO Score 8

- VantageScore 3.0

- Their own credit score models

The FICO Score 8 is the gold standard credit score and is used by about 90% of the top lenders. Comparably, the VantageScore 3.0 is newer and isn’t used as much as the FICO Score, but has gained prominence in recent years.

Moreover, most lenders also have in house credit score models that are hidden from the public eye. Therefore, we will only cover the FICO Score 8, and VantageScore 3.0 since information about these models are public.

While a 700 FICO Score and 700 VantageScore don’t mean the same thing, changes to one score will likely cause similar changes in the other.

Why Is Your Credit Score So Important?

Your credit score plays a critical role in deciding your approval odds and interest rates. Furthermore, in terms of mortgages, a minor boost of 25 points to your credit score could save you thousands of dollars.

Let’s glance at the table below, which showcases the average fixed interest rates for a 30-year $100,000 mortgage at differing ranges of credit scores.

| 30-Year Fixed Rate $100k Loan (7/7/2020) | |||

|---|---|---|---|

| FICO Score | APR | Monthly Payment | Total Interest Paid On Loan |

| 760-850 | 2.837 % | $413 | $48,631 |

| 700-759 | 3.059 % | $425 | $52,925 |

| 680-699 | 3.236 % | $434 | $56,398 |

| 660-679 | 3.45 % | $446 | $60,653 |

| 640-659 | 3.88 % | $471 | $69,388 |

| 620-639 | 4.426 % | $502 | $80,827 |

Bumping your credit score just about 25 points from 640-659 to 660-679 could save you about $8,000. That’s a lot of savings for such a small bump to your credit score.

Now, say you pushed your score to somewhere to 760-850. This move could end up saving you about $20,000. Crazy!

We’ve been talking about mortgages, but what about credit cards?

The best credit cards are available to those with higher credit scores. Lenders are willing to reward their consumers with the lowest risk of default since the defaults cost far more than a few more cashback percentage points.

Moreover, a low credit score could make it hard to get approved for a mortgage, credit card, and student loan. It might even make it difficult to rent an apartment or get a job. Consequently, being proactive about your credit score is vital.

What Is A Good Credit Score?

What defines a “good credit score” honestly differs from lender to lender and from model to model. However, a good score is typically considered “middle-of-the-pack.” Not as good as an excellent score, but better than a poor score.

What Is A Good FICO Score?

FICO Scores are subdivided into the following five tiers:

- Exceptional: 800-850

- Very good: 740-799

- Good: 670-739

- Fair: 580-669

- Very poor: 300-579

In 2019, the average FICO Score in the United States was 703, meaning the typical American had a good credit score. According to Experian, only 8% of those with good scores are likely to default on their loans. Thus, those with good scores generally start tapping into some of the better products available on the market.

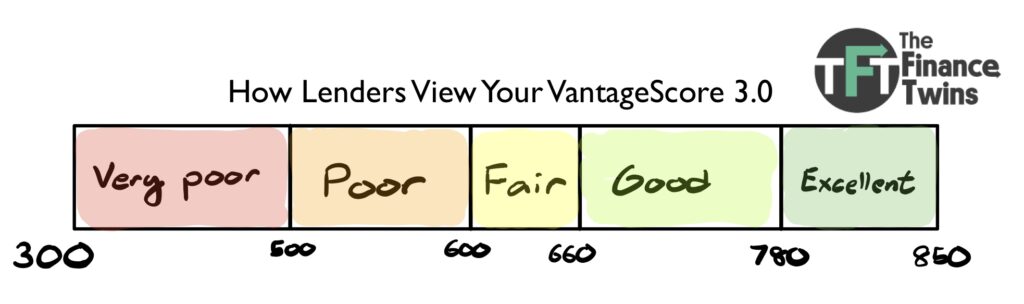

What Is A Good VantageScore?

VantageScore 3.0 is also similarly divvied up into groups:

- Excellent: 781-850

- Good: 661-780

- Fair: 601-660

- Poor: 500-600

- Very poor: 300-499

Notice that the range for good VantageScores varies much more than that for good FICO Scores. Despite both scores ranging from 300 to 850, this differentiation just goes to show just how much the two models differ from one another.

Since good VantageScores seem to take the upper end of the spectrum, it’s no surprise that applicants with these scores can get approved for more competitive products.

Wait, Aren’t There More Credit Scores?

Yes, there are many more types of credit scores with their own definition of “good.” However, given that these models’ scoring systems are kept under wraps and aren’t as widely used as the FICO and VantageScore, it’s not worth worrying about them too much.

Most major swings in your FICO or VantageScore will reflect across all your scores. Don’t start watching every score possible with eagle eyes. It’s not worth your time and energy.

What Is A Good Score For A Mortgage?

Lenders typically see FICO scores above 760 as enough to qualify for the best rates and terms available. At this level, you’ll get the lowest interest rates. Lenders view you as a safe investment and treat you nicely.

Any score above 760 won’t help you that much. It’s just extra credit at that point.

Mortgages also come in all shapes and sizes, and your credit score still plays a significant role in influencing factors. For example, FHA loan down payments depends on your credit score.

- Credit score greater than 580: 3.5% down payment

- 500-580: 10% down payment

Moreover, you can apply for USDA mortgages with a good credit score. USDA loans offer low-interest rates, don’t even require a down payment, and have other great perks.

A good credit score will save you money and help you qualify for the best mortgage options available.

What Is A Good Score For An Auto Loan?

Most people will need to take out a loan when getting their first car. Thus, your credit score unsurprisingly plays a significant role in deciding your approval odds and interest rates.

Generally speaking, having a credit score of 660 at minimum will qualify you for competitive rates. A bad credit score will lead to much higher interest rates and make car insurance premiums skyrocket.

Once again, a good credit score will save you thousands of dollars in the long run.

What Is A Good Score For A Credit Card?

Although it’s hard to quantify precisely what score is needed to get the top credit cards available, the trend is that the higher your score, the easier it is to get the best cards around.

However, you’re eligible for some great credit cards once you start hitting a score around 700.

| Credit Card Name | Cash Back Rate | Annual Fee | Credit Score Needed |

|---|---|---|---|

| Discover it Cash Back | 5% | $0 | 680 |

| Chase Freedom Unlimited | 1.50% | $0 | 670 |

| Citi Double Cash Card | 2% | $0 | 740 |

What Affects My Credit Score?

Several factors are involved in calculating your credit score. However, since the FICO Score and VantageScore are different models, they use various components and weights.

Though drastic changes to one score will lead to similar changes in other scores. For example, making a late payment 30 days past the due date will hurt your FICO and VantageScores.

FICO Score

The FICO Score is the oldest and most widely used credit score model. It’s broken down into five different categories:

- Payment history (35%) – have you missed any payments?

- Credit utilization (30%) – do you use less than 30% of your total credit limit?

- Average account age (15%) – how old is the average age of your credit?

- Credit inquiries (10%) – how many credit cards have you opened in the past year?

- Credit mix (10%) – do you have a good combination of credit cards, loans, and other accounts?

One of the biggest factors differentiating between the FICO and VantageScore models is that your FICO Score factors in all open and closed accounts in your account age. The VantageScore 3.0 only looks at open accounts. This factor can lead to stark differences between the two scores, especially after closing an older account.

VantageScore

The VantageScore 3.0 is a model that has more factors and awards individuals for good debt-paying behaviors. For example, by paying off your mortgage, you’ll reduce your debt, boosting your VantageScore 3.0 but not your FICO Score.

- Payment history (40%) – have you missed any payments?

- Average account age and type of credit (21%) – how old is the average age of your credit?

- Credit utilization (20%) – what percent of your total credit limit do you use?

- Total balances/debt (11%) – how much debt do you owe?

- Recent credit behavior and inquiries (5%) – how many credit lines have you opened in the past year?

- Available credit (3%) – how much credit do you have?

How Can I Monitor My Credit Score?

Watching your credit score is one of the best ways to start improving it. By keeping your eyes on your credit score, you can:

- See your credit score building efforts come to life

- Guard against identity theft

- Find mistakes in your credit score

Some credit monitoring companies like Credit Karma and Credit Sesame offer their services completely free of charge. They also provide additional services and tools, such as debt monitoring, credit score simulators, and free tax filing.

How Can I Get A Good Credit Score?

We all want to improve our credit score, but it can seem like a daunting task.

If you’re trying to increase your credit score, it’s essential to make sure you first fully understand how your credit score works. Then, make sure you have looked into tools such as Credit Karma and Credit Sesame to ensure you have ways to watch your credit score.

Once you’ve done those two steps, you can start exploring ways to help your credit score.

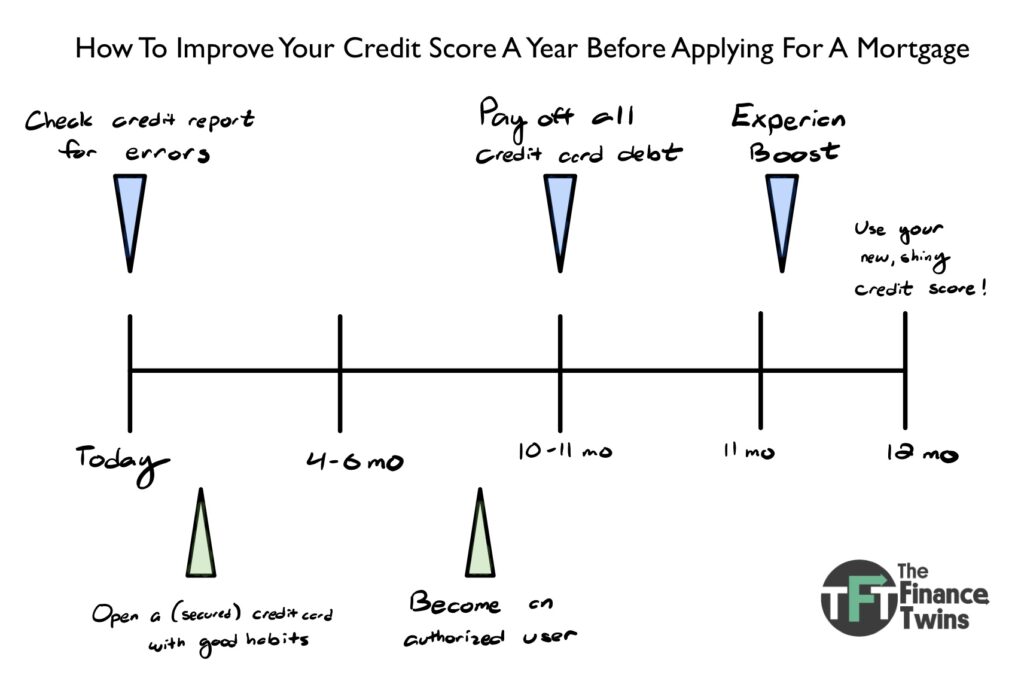

Getting your credit score up to a good range could save you thousands of dollars and give you lower interest rates. You can use a few techniques to easily boost your credit score, but they vary by how much time you have before you plan on using your credit score. See the timeline below!

Check Your Credit Report For Errors

Sometimes the credit bureaus make mistakes on your credit report. The Federal Trade Commission estimates about 20% of consumers have errors in their credit scores.

Unfortunately, it takes months for errors to be corrected.

Thus, if you plan on using your credit score, make sure to thoroughly examine your credit six months beforehand. This timeframe will give you plenty of time to file a dispute.

Pay Off Your Credit Cards

Your credit card utilization is worth 35% of your FICO score. This ratio is representative of your credit use divided by your total credit limit.

The lower your credit utilization, the higher your credit score.

The great thing about this utilization ratio is that it resets every month. Therefore, you can minimize your utilization in the months before using your credit score.

One to three months beforehand, pay off all your credit cards weekly. This move will keep your utilization ratio near 0% when your card company reports your utilization to the credit bureaus.

A 0% utilization ratio makes the FICO and VantageScore algorithms very happy, and you’ll see your credit score quickly rising.

Become An Authorized User

Say you have a poor credit score, but your dad has an excellent one. He has had a credit card for over 30 years, hasn’t missed a single payment, and has a giant credit limit.

If your dad adds you as an authorized user (AU) to his credit card, all of his credit cards’ history add to your credit report. This excellent history will give your score an enormous boost. Simply put, your credit score will piggyback off of other’s excellent credit histories.

Becoming an AU will affect your credit score either immediately or in a few weeks. Given that AUs can really help your score, it’s best to become one at least a month beforehand to ensure the effects settle down.

Use Credit Score Boosting Tools

Disclaimer: some of these tools may cause unintended consequences. For example, Experian Boost has been noted to worsen your debt-to-income ratio.

Experian Boost is a free tool that factors on-time utility and telecom payments that aren’t typically used in credit score calculations. This method will likely give your VantageScore 3.0 an immediate boost.

Experian Boost effects aren’t permanent, and you can remove them from your score at any time.

What Can I Do To Get Excellent Credit?

You’re shooting for the stars now. If you want to achieve an excellent credit score, make sure you have read the previous section first. The techniques here will hopefully help you fill in the cracks.

Open A Credit Card With Good Habits

Opening another credit card on your history can be beneficial. Presuming you maintain excellent credit card habits, you’ll rake in credit score boosts.

Firstly, your credit utilization ratio will decrease. This new card will increase your total credit limit and increase the denominator in your credit card ratio. Thus, your ratio becomes smaller.

Next, if you maintain a good repayment history, then the payment history portion of your credit score will also improve.

Finally, adding a credit card could improve your credit mix.

However, opening too many credit cards could hurt your credit score. Every time you apply for a credit card, the lender will do a “hard pull” on your credit report, which will temporarily ding your score for 24 months.

Getting a new card has a tangible effect on your credit score after just a few weeks, but positive effects increase the longer you wait. Note that everything we’ve just described also applies to secured credit cards.

Ask For Credit Limit Increases

Remember that your credit utilization comprises 35% of your credit score.

By contacting your existing credit card issuers and asking for a credit limit increase, you will effectively decrease your credit utilization ratio. The lower your ratio, the higher your credit score.

It also doesn’t hurt to try. The worse they can say is no, and these few extra points could help bump your credit score.

Do Lenders Only Look At Your Credit Score?

Definitely not. Depending on what you’re applying for, lenders will typically ask for more information. Other factors include your debt-to-income ratio, income history, down payment, and loan-to-value ratio, which are critical additional measures to gauge your default risk.

For instance, when applying for a mortgage, lenders will request for everything. Considering they’ll be giving you hundreds of thousands of dollars, they want to make sure that they can get that money back.

Whereas when applying for a credit card, the lender typically won’t be giving you too much money. Thus, they’ll generally only delve into your credit score and income.

Frequently Asked Questions (FAQ)

That’s ok!

You can start building your credit score anytime. With no credit history, it’s best to take a look into secured credit cards or credit-building loans. These products are intended for those with little or poor credit history and can help set your credit journey in the right direction.

In short, a soft inquiry won’t hurt your credit score, but a hard inquiry will.

Soft pulls are like a snapshot of your credit history, but a hard pull delves into every pixel. Every hard inquiry will leave a slight negative impact on your credit score. Though, hard inquiries only last 24 mo and have little effect on your credit score.

Several things can happen. Firstly, your credit utilization ratio will likely increase. For example, by closing a credit card account, you’ll have less of a total credit limit. Since you’ll then be using the same amount of credit on a smaller limit, your ratio will increase.

Second, your average account age will decrease. Taking off any existing accounts will either reduce your score or do nothing, but cannot help your score.

Closing an account should be a very carefully thought out decision, considering there are many adverse effects on your credit score.

John Ta is an undergrad at the University of Pennsylvania and the founder of Penn’s first undergrad personal finance club, Penn Common Cents. As a first-generation college student, he had to learn everything about personal finance on his own and seeks to mend the financial literacy knowledge gap seen almost everywhere. John is currently studying for an MS in Chemistry and a BA in Physics (business & tech concentration), Biochemistry, and Biophysics and is interested in the intersections of finance and healthcare.